As of mid-2025, the question of whether China Southern Airlines will join the Oneworld Alliance remains a topic of speculation in the aviation industry.

Background: China Southern and Oneworld in 2025

China Southern Airlines, China’s largest carrier by fleet size and passenger volume, left the SkyTeam Alliance in 2019 after a decade of membership. Since then, it has pursued strategic partnerships with several Oneworld members, including American Airlines, British Airways, Qatar Airways, and Finnair, fueling ongoing speculation about a potential move to Oneworld. Reports from 2022 and 2024 indicated discussions between China Southern and Oneworld, but no formal application has been confirmed as of June 2025. The addition of Oman Air and Fiji Airways to Oneworld as full members in 2025 shows the alliance’s intent to expand, but China Southern’s status remains uncertain.

Pros of China Southern Joining Oneworld

- Mainland China Presence:

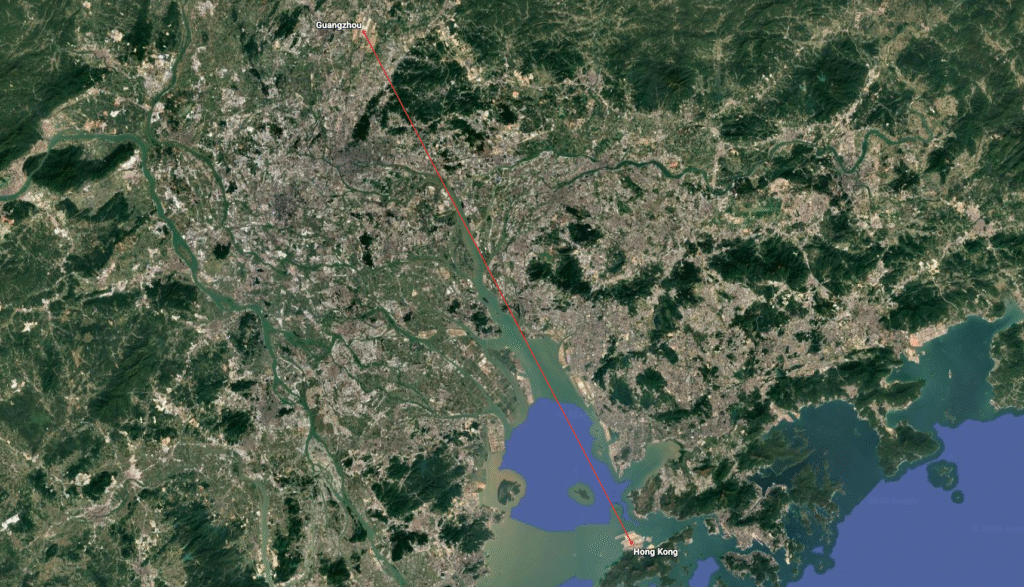

- Oneworld currently lacks a mainland China-based member, unlike SkyTeam (China Eastern, Xiamen Airlines) and Star Alliance (Air China, Shenzhen Airlines). China Southern’s extensive network, with hubs in Guangzhou and Beijing, would fill this gap, providing Oneworld with access to one of the world’s largest aviation markets.

- This would enhance Oneworld’s competitiveness in Asia, where it currently relies on Cathay Pacific (Hong Kong) and Japan Airlines for regional coverage.

- Enhanced Connectivity and Network:

- China Southern operates to 208 destinations across 31 countries, offering Oneworld members valuable domestic and international connections in China. This would benefit frequent flyers with seamless transfers, codeshare agreements, and access to China Southern’s routes, particularly on high-demand China-Europe and China-Australia corridors.

- Partnerships with Oneworld members like Qantas and British Airways could be strengthened, consolidating routes like China-Australia.

- Frequent Flyer Benefits:

- Joining Oneworld would allow passengers to earn and redeem miles across the alliance’s 14 member airlines, including American Airlines’ AAdvantage and British Airways’ Avios programs. This would attract loyalty program members and boost customer retention.

- Oneworld’s top-tier (Emerald and Sapphire) members would gain access to China Southern’s lounges and baggage allowances, enhancing the alliance’s value proposition.

- Strategic Balance in China:

- Adding China Southern would create a more balanced “1+1+1” structure among the three major alliances in China (Star Alliance: Air China; SkyTeam: China Eastern; Oneworld: China Southern). This would level the playing field, especially as SkyTeam and Star Alliance have stronger Chinese representation.

- Support from Key Oneworld Members:

Cons of China Southern Joining Oneworld

- Cathay Pacific’s Veto Power:

- As a founding Oneworld member, Cathay Pacific has veto rights over new members. Guangzhou, China Southern’s hub, is less than 100 miles from Hong Kong, making China Southern a direct competitor. Cathay Pacific has historically opposed China Southern’s entry due to potential market share loss.

- Speculation persists that Cathay Pacific might leave Oneworld for Star Alliance, especially given Air China’s 30% stake in Cathay, but this remains unconfirmed and could complicate negotiations.

- Operational and Cultural Challenges:

- China Southern’s service quality has been criticized, with some describing poor customer service and inconsistent inflight experiences. Aligning with Oneworld’s standards, which emphasize a “superior, seamless travel experience,” could require significant investment.

- Integration into Oneworld’s IT systems, ticketing, and loyalty programs typically takes 12-18 months, and China’s regulatory environment could further delay or complicate this process.

- Geopolitical and Regulatory Risks:

- Joining Oneworld could present some challenges for China Southern due to the complexities of international aviation regulations and geopolitical dynamics. Operating in China’s highly regulated aviation market, China Southern must navigate government oversight, which can impact decisions about international alliances. Aligning with Oneworld may involve coordination with multiple stakeholders, potentially slowing the process.

- Additionally, global travel uncertainties, including varying travel policies and economic fluctuations, could affect the timing and benefits of membership, requiring careful planning to ensure a smooth integration.

- Competition Within the Alliance:

- China Southern’s entry could cannibalize traffic from Cathay Pacific, Japan Airlines, and Malaysia Airlines on Asian routes. This internal competition might deter some members from supporting the move.

- Xiamen Airlines, 55% owned by China Southern and a SkyTeam member, could create conflicts of interest if China Southern joins Oneworld, potentially requiring Xiamen to exit SkyTeam or remain independent.

- Limited Short-Term Benefits:

Competition and Market Dynamics

The competitive landscape in China’s aviation market is intense, with SkyTeam and Star Alliance holding an edge due to their mainland Chinese members. Oneworld’s lack of a mainland carrier puts it at a disadvantage, particularly as China’s aviation market was one of the fastest-growing pre-COVID.

- SkyTeam: China Eastern and Xiamen Airlines provide extensive coverage, bolstered by Delta Air Lines’ investment in China Eastern. SkyTeam’s strong presence in Greater China makes it a formidable competitor.

- Star Alliance: Air China and Shenzhen Airlines offer robust connectivity, with Air China’s 30% stake in Cathay Pacific adding complexity to Oneworld’s strategy. A potential Cathay Pacific move to Star Alliance could further tilt the balance.

- Independent Strategy: China Southern’s current approach of forging bilateral partnerships (e.g., with American Airlines, British Airways, and Qatar Airways) allows flexibility without the constraints of full alliance membership. This mirrors LATAM’s strategy post-Oneworld, prioritizing joint ventures over alliances.

Oneworld’s recent additions, like Oman Air and Fiji Airways, show a focus on expanding in underserved regions (Middle East, South Pacific). However, China remains a critical gap, and China Southern’s scale makes it a prime target.

Likelihood of China Southern Joining Oneworld in 2025

The likelihood of China Southern joining Oneworld by the end of 2025 is moderate to low, primarily due to Cathay Pacific’s opposition and strategic considerations:

- Cathay Pacific’s Veto: Cathay’s historical resistance to China Southern’s entry, driven by competitive concerns, remains the biggest hurdle. Even post-pandemic, with Cathay under pressure from Air China’s influence, it’s unlikely to relent without significant concessions, such as a swap where Cathay joins Star Alliance.

- Oneworld Connect as a Compromise: A more plausible scenario is China Southern joining as an Oneworld Connect partner, a “light” membership offering limited benefits like codeshares and some frequent flyer perks. This would avoid a full veto while providing Oneworld access to China Southern’s network. However, with Fiji Airways transitioning from Connect to full membership in 2025, the Connect program’s future is unclear.

- Strategic Priorities: China Southern’s stated goal of becoming the “world’s largest airline” and its preference for flexible partnerships suggest it may not prioritize alliance membership. Its existing ties with Oneworld carriers already provide many benefits without the costs of full integration.

- Timing and Logistics: Alliance integration takes 12-18 months, and with no formal application reported by mid-2025, a full membership announcement this year is unlikely. Discussions may continue, but progress is slowed by China’s regulatory environment and global travel uncertainties.