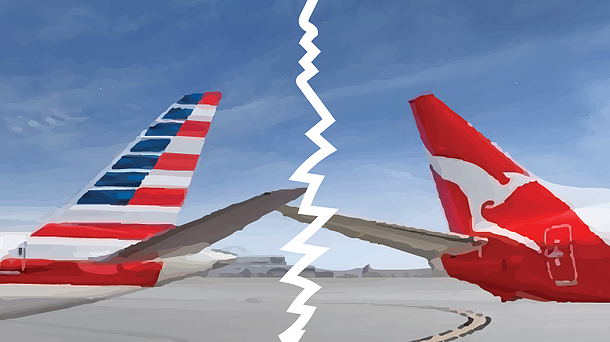

The recent decision by the United States Department of Transport (DOT) disallowing an expanded alliance and anti-trust immunity on the trans-pacific route between Qantas and American Airlines (AA) was surely a letdown. Most Qantas and AA elite frequent flyers would have been really looking forward to the approval of the joint venture which will mean better points/status earning and upgrades opportunities.

Anyway, for the the sake brevity, this intimate partnership I am going to refer to is not the usual code-share agreement that most airlines have with each other. Qantas was looking forward to a joint venture similar to the arrangement with Emirates in 2013 when Qantas ditched the familiar Singapore stopover en route to London, but with American Airlines this time.

Like I mentioned before, this sort of intimate partnership is not quite well understood to most people outside of the industry. Unlike a codeshare agreement, a joint venture allows revenues to be shared between the carriers. Thus, giving passengers greater flexibility and choices to fly with any carrier operated by QF or AA because,

“their incentives are fully aligned, their optimal strategy is to collaborate, innovate, and integrate their networks to generate as much traffic as possible on joint business routes.”

In other words, if you were booked on some low booking class (discounted) fares on Qantas, there is a chance that the aircraft may be operated by a partnering airline – in this case, AA. However, in the absence of the joint venture, there is no financial incentive for an airline to direct passengers to their competitors airline whether or not, there is a codeshare agreement (a totally different story). The priority is to focus on filling their own planes rather than their competitors and this is especially true for discounted fares.

So what exactly did Qantas applied to the DOT that was rejected? Well here are the juicy bits…

-

Under the expanded Qantas-American Airlines arrangement customers will be able to (subject to regulatory approval):

-

Access 45 services per week (combined) across the Pacific to mainland North America; this includes an increase in services from Sydney to Los Angeles from 14 to 17 per week.

-

Access more than 150 destinations throughout North America on American Airline’s extensive network from Dallas/Fort Worth, Los Angeles and San Francisco including more than 50 destinations from Los Angeles.

-

From Sydney access more than 60 Qantas Group destinations across Australia and New Zealand. The enhanced joint business partnership also provides opportunities for future growth into trans-Pacific markets not currently served by either airline, such as New Zealand.

-

Fly American Airlines’ new flagship B777-300ER on the Sydney-Los Angeles route; featuring a three-class cabin configuration with fully lie-flat seats in First and Business Class, international Wi-Fi, and more customer and cargo capacity than any other aircraft currently in American’s fleet. Qantas will codeshare on these services.

-

Fly Qantas’ reconfigured B747-400 six times per week on the Sydney-San Francisco route; featuring the same product found on the airline’s A380s, including Marc Newson’s fully-flat Skybed in Business, award winning Economy cabin and large -seat-back screens in each cabin with over 1500 entertainment options. American Airlines will codeshare on these services.

-

Benefit from the 9% net increase in capacity on the Australian- mainland US routes and 6% net increase on the Sydney- Los Angeles market.

The DOT argues that if Qantas and AA were to go into a joint venture, they would have control of nearly 60% of the market’s share for flights between the US and Australia. This was the reason behind DOT’s refusal to grant them the antitrust immunity believing that it will lead to significant reduction in competition and consumer choices. Not to mention, many American carriers (including Air New Zealand) lobbied against the QF-AA alliance and opined that this arrangement is not transparent and fair. Besides, Qantas already has one of the biggest codeshare agreement with American Airlines and together they play a crucial role in the OneWorld Alliance.

Furthermore, Qantas has a similar joint venture with Emirates that serves the Europe, Middle East and Africa as well as with China Eastern in the Chinese Market. Now that the marriage has broken down, due to no fault of their own – the ones that stand to lose out the most would be the frequent fliers who traverse between the two continents.